Compare the Big Mac Index and PPP for regional pricing decisions, and learn when to use each.

Pricing teams often use affordability indicators to avoid relying on currency conversion alone. Two common signals are the Big Mac Index and purchasing power parity (PPP). Each has strengths, and each has limitations.

If you want the fundamentals, see What is Regional Pricing.

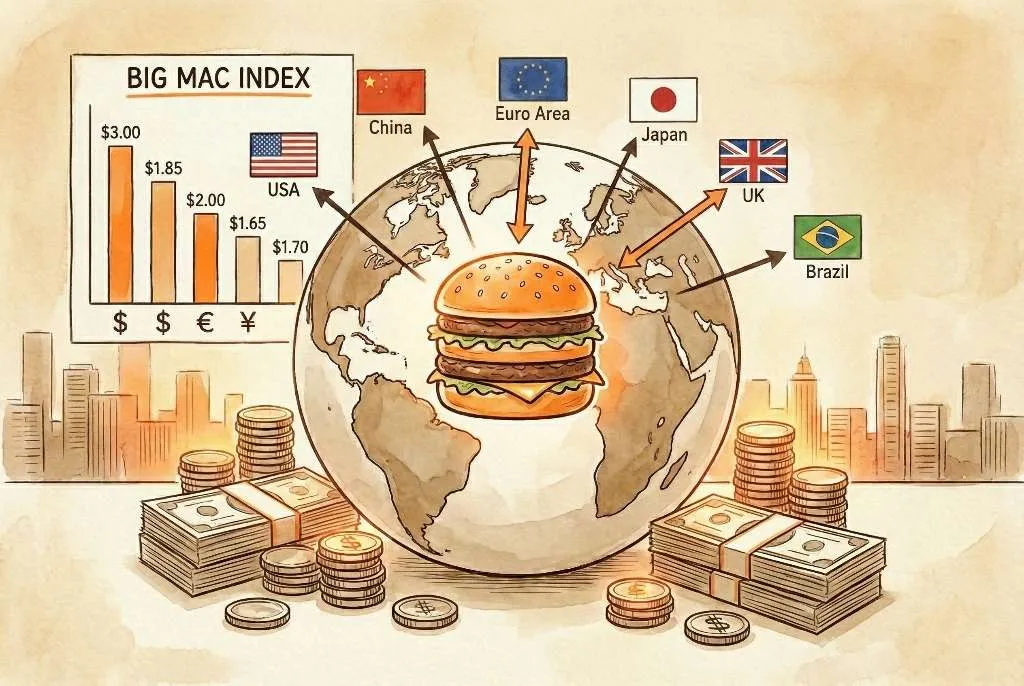

The Big Mac Index uses the price of a common product to compare affordability across countries. It is simple, intuitive, and easy to explain to stakeholders. It is best used as a directional signal rather than a strict pricing rule.

Because it is based on one product, local taxes, supply chain costs, and restaurant pricing strategy can influence the result. That is why it works best as a quick sanity check rather than a final pricing model.

PPP compares a basket of goods across countries to estimate local price levels. For pricing teams, it is usually a stronger baseline because it reflects broader affordability rather than a single product.

PPP is more stable for tiering, which makes it useful for subscription and SaaS pricing that needs consistent guardrails across many markets.

Big Mac Index

PPP

In practice, most teams use PPP for the base model and the Big Mac Index for a quick check on edge cases or outliers.

If you are pricing a consumer product with broad reach, the Big Mac Index can be a helpful storytelling tool. If you are pricing B2B or SaaS products, PPP usually aligns better with the income and cost structures your buyers face.

To test both signals quickly, try the regional pricing tool.

This approach keeps your strategy data-driven without overfitting to any single indicator.

For a deeper pricing workflow, read Set the Right Price Globally.

Is the Big Mac Index reliable for pricing?

It is useful as a directional signal, but it should not be your only pricing input.

Why not use exchange rates alone?

FX does not capture local affordability, so prices can feel too high or too low.

Can I combine PPP and the Big Mac Index?

Yes. Use PPP for the baseline and the Big Mac Index as a quick cross-check.

Which is better for SaaS pricing?

PPP is usually better because it aligns with income and affordability.

How often should I revisit these indicators?

Quarterly reviews are common, especially in volatile markets.

PPP is the more robust baseline for regional pricing, while the Big Mac Index is a fast, intuitive cross-check. Use both signals with guardrails and local context to keep prices fair and profitable.

Written on: Jan 21, 2026